Living Trust Cost in Arizona: What You'll Actually Pay in 2026

Reviewed February 18, 2026

What do you know about the costs associated with creating a living trust in Arizona? Read our blog to understand it better.

A living trust in Arizona typically costs between $2,000 and $4,500 for most families — but the exact price depends on your estate’s complexity, the type of trust you need, and whether you work with an attorney or use an online service. At Citadel Law Firm, we offer flat-fee pricing so you know exactly what you’ll pay before you commit. In this guide, our Chandler estate planning attorneys break down every cost factor so you can make the best decision for your family.

If you haven’t made any plans for your estate, you’re not alone. Recent surveys reveal that up to 65 percent of Americans do not have a current estate plan. “

A living trust is a critical part of a successful estate plan. As an essential estate planning tool, it helps in organizing and managing your assets effectively. The initial cost of setting up a living trust in Arizona can vary depending on factors like complexity and whether you use a do-it-yourself approach or professional legal assistance, and is governed by the Arizona Trust Code (ATC). But how much should you plan on spending on one in Arizona?

By the time you finish reading this article, you will have a solid understanding of how much a living trust in Arizona costs and why you should consider having one drawn up.

Cost of a Living Trust in Arizona

Creating a living trust in Arizona varies in price. The initial cost of a living trust depends on several factors, including attorney fees, court fees, and ongoing management fees. The living trust cost also depends on how a person sets up the trust. Setting up trusts in Arizona is a great estate planning strategy as Arizona has some of the best living trusts laws in the country.

Begin with a qualified attorney. Each attorney has a different fee structure that will determine your final cost. Make sure you hire an attorney who has expertise in trusts. Attorney fees can range from $200 to $700+ depending on experience and fee structure.

Attorneys each have a different specialty, much like doctors. Some will specialize in criminal law, for example. You need an attorney specializing in estate planning law with experience writing trusts. The trust document is not just a legal document, it is a whole estate plan strategy specific for your needs after your death, managing a person’s assets during their lifetime. Fee structures may be based on flat fees or hourly rates; flat fees provide cost predictability, while hourly rates may vary depending on the complexity of the estate.

A simple, individual living trust typically starts around $2,000 to $2,500. Many clients opt for comprehensive trust packages costing between $2,500 and $4,500, while complex estates or married couples may pay $5,000 to $10,000 or more. Estate planning services in metropolitan areas of Arizona tend to be higher than in rural areas. Comprehensive trust packages may include pour-over wills, powers of attorney, and property deed transfers. Ongoing management fees and investment management costs can add to the overall cost, especially for complex trusts. The first factor affecting cost is the complexity of the estate. Long-term savings from avoiding probate can result in thousands of dollars saved in attorney fees and court costs.

In case you become incapacitated a trusts in Arizona should also have a successor trustee that can make decisions for you (assuming you are your own trust during life).

Discussing Fee Rates

When you find your attorney, discuss the fee rates. The State Bar of Arizona website will have a list of qualified estate planning lawyers in Arizona.

Attorney fees are a significant part of the overall living trust Arizona cost, and these can be structured as flat fees or hourly rates. Flat fees offer transparency and predictability, while hourly rates may vary depending on the complexity of your estate. Be sure to discuss with your lawyer whether they charge flat fees or hourly rates, and what the typical cost range is for your situation.

In addition to attorney fees, court fees may also apply if probate is involved, adding to the total cost of estate planning.

Look for an attorney who specializes in drawing up trusts.

Flat Fee Living Trust Costs

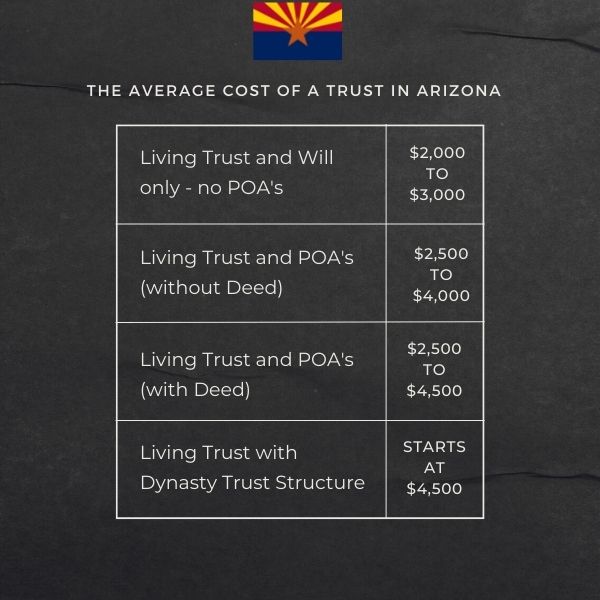

If you hire an attorney you will usually pay a flat fee, which provides transparency and predictability in costs compared to hourly billing. Some attorneys will do it hourly but it is not common. The average cost of a trust in the Phoenix East Valley is:

Living Trust and Will only – no POA’s -> $2,000 to $3,000

Living Trust and POA’s (without Deed) -> $2,500 to $4,000

Living Trust and POA’s (with Deed) -> $2,500 to $4,500

Living Trust with Dynasty Trust Structure -> starts at $4,500 (usually recommended for Blended families and large estates)

After the trust is established, ongoing management fees and investment management costs may apply, depending on the complexity of the trust and the assets involved. These management fees can include expenses related to trust administration, investment management, and tax filings, and should be considered as part of the overall living trust cost.

Hourly rate for Estate Planning Attorney

Attorney fees for estate planning in the Phoenix East Valley can range from $200 to $700+ depending on the attorney’s experience and fee structure. The hourly rate for an estate planning attorney is usually between $300, but it can get up to $600 for attorneys that do litigation (for contest estates). Flat fees are more common for living trusts, providing clients with transparency and predictability in costs, while hourly rates are typically reserved for litigation or more complex cases. Most attorneys will not do a Living Trust on an hourly basis as it will end up being more expensive for the client.

What Is a Living Trust?

A living trust is a trust that takes place while a settlor is still alive. It is also known as a revocable living trust. In Arizona, living trusts are governed by the Arizona Trust Code (ATC). It is a tool for estate planning that allows one individual to hold property for the benefit of a third party or for its own benefit. To understand the living trust, you must first understand the parties involved:

- Trustee: The person holding the property

- Settlor: The person whose property is being held

- Beneficiary: The person for whom the property is being held. There are usually multiple beneficiaries to a living trust.

A living trust allows for the management and transfer of a person’s assets, including personal property, both during their lifetime and after their passing.

To set up a living trust in Arizona, you must draft a trust document that outlines the details of the trust, including the appointed trustee and beneficiaries. The trust document must be notarized to be legally valid. Funding the trust by transferring property and assets into the trust is crucial for its legal effectiveness.

A living trust will ultimately eliminate a messy probate process after the settlor dies. The settlor will legally set up the trust, which allows the trustee to manage their assets which eventually go to the beneficiary, which can be your children or even your grandchildren if you do a generation skipping trust.

Types of Living Trusts

If you’re thinking about estate planning here in Arizona, I want to walk you through the different types of living trusts available to you. Each one serves a specific purpose, and understanding your options will help us find the right fit for your unique situation. Think of this as choosing the right tool for the job—each trust type offers distinct benefits that can protect your assets, take care of your loved ones, and give you peace of mind.

- Revocable Living Trusts: This is where most of my clients start, and for good reason. With a revocable living trust, you stay in complete control of your assets while you’re alive. You can change it, update it, or even cancel it entirely if your circumstances change—that’s the beauty of “revocable.” What makes this so appealing is that it helps your family avoid the lengthy and public probate process when you’re gone. Your private family matters stay private, and your loved ones can access what you’ve left them much more quickly and easily.

- Irrevocable Living Trusts: Now, these require a bigger commitment because once you set them up, they’re essentially set in stone. But here’s why you might want to consider this option: irrevocable trusts can provide powerful protection from creditors and offer significant tax benefits. They’re also excellent for charitable giving strategies. I’ll be honest with you—these require careful planning and aren’t right for everyone, but for certain situations, they can be incredibly valuable tools.

- Joint Living Trusts: If you’re married, this might be exactly what you and your spouse need. Instead of creating separate trusts, you combine everything into one streamlined trust. This approach cuts down on paperwork, reduces legal costs, and makes managing your estate much simpler. It’s particularly helpful for ensuring that when one spouse passes away, the surviving spouse can seamlessly continue managing the family’s assets without unnecessary complications.

- Special Needs Trusts: This is where my heart really goes out to families. If you have a child or loved one with a disability, you’re probably worried about their long-term care and financial security. A special needs trust lets you provide for them without putting their government benefits at risk. It’s a way to show your love and ensure their care continues, while working within the complex rules of federal and state benefit programs.

- Charitable Remainder Trusts: For those of you who want to support causes close to your heart while still providing for yourselves and your families, this option gives you the best of both worlds. You can generate income for yourself or your beneficiaries for a specific period, and then the remainder goes to your chosen charity. Plus, you’ll enjoy some nice tax benefits along the way. It’s a beautiful way to create a lasting legacy.

- Bypass Trusts (Credit Shelter Trusts): If you’re a married couple with significant assets, these trusts can be a game-changer for preserving your family’s wealth. Here’s how it works: when the first spouse dies, a portion of the assets goes into this special trust, which isn’t subject to estate taxes. This strategy can save your family thousands—sometimes hundreds of thousands—in taxes, leaving more for your children and grandchildren.

- Generation-Skipping Trusts: Maybe you want to leave something directly to your grandchildren, or you’re thinking several generations ahead. These trusts help you bypass the tax burden that would normally hit each generation, allowing more of your wealth to actually reach the people you want to benefit. They’re particularly valuable for larger estates where tax efficiency can make a dramatic difference over time.

Choosing the right trust isn’t something you should do alone, and frankly, you shouldn’t have to. Arizona has specific laws about community property and trust administration that can significantly impact how your trust should be structured. That’s where I come in—I want to make sure we design something that fits your family perfectly, follows all the rules, and gives you the strongest possible protection. Every family’s situation is different, and your trust should reflect that. Let’s work together to create a plan that gives you confidence and protects what matters most to you.

Why Get a Living Trust in Arizona?

When you opt to create a living trust, you remove the burden of the probate process for your heirs. Probate refers to the legal process your assets go through after you die. Such a process ensures the state distributes your assets according to your wishes.

If you have a living trust that has been properly funded, your estate will not go into probate.

With that said, the Arizona Uniform Probate Code has made the probate process much easier than it used to be. The current probate rules do not require formal court approval or even personal appearances in court in some cases. The probate laws work exceptionally well for those who have an estate of less than $200,000.

With that said, if you have a more significant estate, you should spend the money to have an attorney design a living trust for your needs. If you’re planning on leaving your property to a minor, you should also have a living trust created. The trustee can care for the property until the minor child comes of age.

Furthermore, you can avoid conservatorship if an illness or accident incapacitates you. In this case, you’ll already have a trustee designated to care for your affairs.

A Living Trust vs. a Will

You will still need to have a will drawn up if you have a living trust. The living trust does not replace this other critical estate document. The will makes some crucial distinctions such as the following things:

- Names the executor

- Provides directions for paying debts and taxes

- Selects a manager for your children’s property

- Establishes who will take guardianship of your children

Ultimately a living trust will do different things. Here are the specific things a living trust does that a will does not:

- May not allow revisions to be made

- Avoids probate court

- Avoids probate and keeps the process private

Both a will and a living trust name a property beneficiary. But a will also does things a living trust does not:

- Names a guardian for children

- Names an executor for the estate

- Avoid probate if not properly funded (to learn more about the importance of funding a trust click here)

It’s also worth noting a living trust will cost more to set up than a will. The trust administration process is much simpler and easier than probate, on top of being less expensive.

A will costs between $1,000 and $1,500 if done by an attorney in AZ. Regardless of what you choose to do, you need an estate plan.

Impact on Taxes

In Arizona (unlike in some other states), a living trust won’t significantly impact your taxes. Your family will not have to pay an inheritance or estate tax in Arizona. If you have an estate of more than $15million or $30 million for a couple (as of 2026), then you have to pay a federal estate tax.

You will have to pay the federal estate tax regardless of whether you have a living trust.

Look Into a Living Trust Today

A living trust is a great way to protect your assets and your loved ones. Our Trust and Wills attorneys in Chandler, AZ will be pleased to help. We can save you money and time by helping you avoid the probate process all together. We also can set up dynasty trusts for a blended family.

Are you interested in having a living trust created by Citadel Law Firm? We can help. Contact us today, and let our experts help you plan for your loved ones. You can call (480) 565-8020 or you can click in the button below to schedule your free estate planning consultation.

Do you want to know more about the cost to get your estate planning done? Read our blog, click here.

When delving into estate planning, it’s essential to consider various aspects, including the cost and convenience of creating legal documents. A popular option is the revocable living trust, known for its flexibility and the ability to avoid probate. Understanding the living revocable trust cost is crucial, and with the advent of online platforms, creating a living trust online has become more accessible. Many individuals opt for package living trust services, which often include not only the trust document but also other estate planning documents like a living will and financial power of attorney. The convenience and affordability of the best online trust platforms make them a go-to choice for those seeking comprehensive and efficient solutions in managing their estate planning needs. They are also a great source of litigation cases for attorneys as most of the times the trusts are not set up correctly.

It is important to remember that only licensed attorneys can provide legal advice and draft enforceable trusts. While beneficiary deeds are available in Arizona for simple, single-property situations, they are not a substitute for comprehensive estate planning and can lead to issues such as disputes, disinheritance, or tax problems.

Frequently Asked Questions About the Purpose of Trusts in Arizona

What is the downside of a living trust in Arizona?

While living trusts offer many benefits, they have some potential drawbacks:

– Cost: Setting up a living trust typically involves higher upfront legal fees compared to a simple will.

– Complexity: Managing a trust can be more complex than a will, requiring ongoing administration and potentially incurring additional costs. Ongoing management fees, investment management, and tax filings are part of the ongoing responsibilities and costs of maintaining a living trust, and these fees can add to the overall cost depending on the complexity of the trust and the assets involved.

– Limited protection from creditors: Revocable living trusts generally don’t protect assets from creditors during the grantor’s lifetime.

– No tax advantages for revocable trusts: Unlike irrevocable trusts, revocable living trusts don’t provide tax benefits during the grantor’s lifetime.

Is a Living Trust Better than a Will in Arizona?

The choice between a living trust and a will depends on individual circumstances. A living trust may be better if:

– You want to avoid probate, which can be time-consuming and costly.

– Privacy is a concern, as trusts aren’t part of the public record unlike wills.

– You own property in multiple states and want to avoid ancillary probate.

– You want more control over asset distribution after death.

However, a will might be sufficient if your estate is simple and you’re not concerned about probate. Consulting an estate planning attorney can help determine the best option for your situation.

What are the reasons to not have a revocable living trust in AZ?

Reasons to reconsider a revocable living trust include:

– You have a small, uncomplicated estate that wouldn’t benefit significantly from avoiding probate.

– The cost of setting up and maintaining the trust outweighs the potential benefits.

– You prefer the court-supervised process of probate, where the court oversees the formal distribution of your assets.

– Your primary goal is reducing estate taxes (revocable trusts don’t provide tax advantages during your lifetime).

At what net worth should you consider a trust in Arizona?

There’s no specific net worth threshold for considering a trust, as it depends on individual circumstances and asset allocation. However, trusts become increasingly beneficial as your estate grows more complex or valuable. Factors to consider include:

– The current federal estate tax exemption (2024 limit: $13.61 million per individual)

– The complexity of your assets (e.g., business interests, out-of-state property)

– Your privacy concerns

– Your desire for control over asset distribution

It’s also important to regularly update your estate plan to include new or existing family members, as changes such as births or deaths should be reflected in your legal documents to prevent disputes or misallocation of assets.

Even with modest estates, trusts can be valuable for avoiding probate or providing for minor children. Consult an estate planning attorney to evaluate your specific situation.

What is the cost difference between a living trust vs. will in Arizona?

The cost of creating a living trusts by an estate planning attorney generally higher than drafting a will:

– Wills typically cost between $1000 to $2,000, depending on complexity.

– Living trusts often range from $2,000 to $3,000 or more.

However, consider long-term costs:

– Wills may incur probate fees, which can be substantial.

– Trusts may have ongoing administration costs but avoid probate expenses

The total cost effectiveness depends on your estate’s size and complexity. An estate planning attorney can provide a more accurate estimate based on your specific needs.

How does a living trust protect assets differently from a will in Arizona?

A living trust offers several asset protection advantages over a will:

– Probate avoidance: Trust assets bypass probate, potentially saving time and money.

– Privacy: Unlike wills, trusts are not public records, keeping your estate details private.

– Continuous management: Trusts allow for seamless asset management if you become incapacitated.

– Flexibility: You can specify complex distribution plans and conditions in a trust.

However, both tools have their place in estate planning. Many people use both a will (often a “pour-over will”) and a living trust for comprehensive coverage.

What is the average cost of a living trust in Arizona?

The average cost of creating a living trust in Arizona typically ranges from $2,000 to $4,500. This cost depends on several factors including the complexity of your estate, whether you hire an attorney or use an online service, and the specific services included in your trust package. For example, a basic revocable living trust prepared by an experienced estate planning attorney usually starts around $2,000 to $3,000. More complex trusts, such as those involving blended families or multiple properties, can cost upwards of $4,500 or more. While online platforms may offer lower initial costs (sometimes as low as $100 to $300), they often lack the personalized advice and professional guidance that an attorney provides, which is crucial for avoiding potential legal pitfalls and ensuring proper funding of the trust.

Can you set up a trust without an attorney in Arizona?

Yes, it is possible to set up a living trust in Arizona without an attorney by using online trust creation services or DIY trust kits. However, doing so carries risks, especially if you have complex assets, multiple beneficiaries, or specific family dynamics to consider. Without professional assistance, you may face costly mistakes such as improper funding, failure to comply with Arizona law, or overlooking important tax law changes.

Properly transferring assets into the trust and ensuring the trust document complies with Arizona community property laws and other state-specific regulations often require professional guidance. Elder law is a specialized area of legal expertise focused on comprehensive estate planning for seniors and vulnerable populations, addressing asset protection, guardianship, and planning for aging-related legal needs. Therefore, many Arizona residents choose to consult with an experienced estate planning attorney to receive personalized advice, avoid legal complications, and ensure their living trust effectively protects their family wealth and avoids probate costs.

Is a $500 living trust too cheap?

A $500 living trust in Arizona is generally considered too cheap to provide comprehensive estate planning. While low-cost or “bargain” trusts may seem appealing, they often come with significant drawbacks. These trusts may use generic templates that do not address Arizona-specific laws, such as community property laws or beneficiary deed rules, and frequently lack proper funding guidance. Beneficiary deeds are sometimes used as a low-cost alternative in Arizona, but they have limitations and are not a substitute for a comprehensive estate plan—relying solely on them can lead to issues like disputes, disinheritance of stepchildren, or tax complications. Without proper funding, the trust may be ineffective, causing assets to still go through the costly and public probate process.

Additionally, inexpensive trusts typically do not include personalized advice or professional assistance, which increases the risk of costly mistakes and family conflict later. For these reasons, investing in a basic revocable living trust prepared by a qualified attorney, even if it costs more upfront, is usually a wiser choice for Arizona residents seeking to protect their assets and ensure smooth asset management.

How much money do you need for a trust to be worth it?

There is no strict minimum amount of money required for a living trust to be worth it in Arizona, but trusts generally become more beneficial as estate complexity and asset value increase. Many estate planning professionals suggest considering a living trust if your net worth exceeds $200,000 or if you own real estate or business interests, especially if these assets are located in multiple states. Trusts are particularly valuable for avoiding probate costs, which can be substantial, and for managing complex assets or family dynamics such as blended families or minor children.

Even for more modest estates, a properly funded trust can provide creditor protection, privacy, and seamless asset management in case of incapacity. Ultimately, the decision depends on your unique circumstances, and consulting with an estate planning attorney can help determine whether a living trust is a cost-effective investment for your family’s needs.

Meet Attorney David Gerszewski

5.0 star rating from 200+ Google Reviews

Attorney David Gerszewski is specialized in Estate Planning, Trust & Probate Law and the founder of Citadel Law Firm PLLC. He is known for making legal matters easy to understand. His background in finance and tax law makes the estate planning strategies he designs for his clients just right. When not practicing law, David enjoys time with his wife, and their amazing dog, Gunner.

EXCELLENTTrustindex verifies that the original source of the review is Google. The team at Citadel Law Firm was professional, competent and thorough. They answered all of our questions and explained options for completing our Estate Plan. I would highly recommend them.Posted onTrustindex verifies that the original source of the review is Google. Was referred my Korey Bahme and what a great referral.. David and his staff was so professional and truly cares about his clients well being. Would highly recommend. Frank SPosted onTrustindex verifies that the original source of the review is Google. We cannot say enough wonderful things about David and Anne! From start to finish, they guided us through our estate planning with a perfect balance of professionalism and genuine kindness. Their expertise gave us complete confidence, and their patient, thoughtful approach set our minds at ease every step of the way. Estate planning can feel overwhelming, but David and Anne made the process clear, organized, and surprisingly stress-free. They took the time to explain every detail, answer our questions thoroughly, and ensure our wishes were fully understood and documented. We truly appreciate their kindness, integrity, and dedication. We highly recommend them to anyone looking for not just exceptional legal services, but also a team that truly cares.Posted onTrustindex verifies that the original source of the review is Google. Can’t say enough good things about Citadel Law ! David and Ann were able to make me feel comfortable throughout the entire process. I needed David to structure a trust that would protect my disabled Son. David did that and more in a way I knew my Son was protected after my death ! I was impressed when David told me he was going to do everything he knew to protect my Son ! Can’t ask for more than that ! Star rating should go to 10 Stars !! RayPosted onTrustindex verifies that the original source of the review is Google. Korey Bahme was incredibly helpful in advising us on how to set up an LLC for our rental property and providing general guidance and landlord information!Posted onTrustindex verifies that the original source of the review is Google. Citadel Law exceeded our expectations. Anne's attention to customer service was first class. She made us feel very welcome and was very attentive to what our needs were. David took care of us and made sure to find out what our estate needs were. We weren't thoroughly sure what a trust was and what that involved, but he helped us understand, as he has a gift for teaching. He spent alot of time with us making sure we understood everything before making a decision on which direction we wanted to go. The whole experience was excellent. I highly recommend Citadel Law.Posted onTrustindex verifies that the original source of the review is Google. What in the world are we supposed to do? The thought of setting up our estate was something we knew we had to do but was easy to put off until tomorrow. We knew we had to do this out of love for our children and grandchildren. Our search for guidance led us to David and Anne from Citadel. David guided us through the creation of a Trust customized to our needs and desires. Anne was a great compliment to the Citadel team and from the moment we spoke with her we felt much more at ease. David took what is a very complex task and made it simple and understandable. We are so happy we did not put this task off another day. We can now live every day knowing when God calls either or both of us home our children will not be stuck with dealing with the government and will be able to get through the mourning process without the worry of what to do with our estate. That task has been done and thanks to David and Anne the next chapter without Mom or Dad will not be a burden. May God Bless David and Anne's ministry. Yes, ministry for they have blessed us abundantly with their caring service protecting us and our family. Fred & JillPosted onTrustindex verifies that the original source of the review is Google. My two sisters and I hired Citadel Law to complete estate planning for the three of us. While we had fairly simple estates to settle, they treated us as if they were planning for their own families. David and Annie (and Gunner) were wonderful. They made the process easy and a great experience, and didn't try and sell us services we didn't need. Cannot recommend them enough.Posted onTrustindex verifies that the original source of the review is Google. David and his staff were very knowledgeable and professional. I was presented with different options and counseled on which best fit my circumstances. It is my pleasure to recommend them.Posted onTrustindex verifies that the original source of the review is Google. Professional and personal service at the highest level. Highly recommend. Felt respected and listened to.

WE WOULD LOVE TO HEAR FROM YOU!

CALL US AT (480) 565-8020

Or use the button below to schedule your free estate planning consultation.