Chandler Trust Lawyer Near Me | Living Trust Attorney Chandler AZ

Why choose our Trust Attorney in Chandler, AZ?

- Experience: Your Local Trust Lawyer in Chandler, Arizona.

- Create a Living Trust to protect your loved ones.

- Price Transparency: Fixed-Price Living Trusts and Estate Plans.

- Living Trusts for Blended Families. We also help with Dynasty Trusts.

- Honesty: we offer Free Review of Out of State Trusts.

Call us at (480) 565-8020

We offer Free Consultations to create a Living Trust for you.

Book a Free Consultation

*You will be redirected to schedule a call with us after submitting the request.

EXCELLENTTrustindex verifies that the original source of the review is Google. The team at Citadel Law Firm was professional, competent and thorough. They answered all of our questions and explained options for completing our Estate Plan. I would highly recommend them.Posted onTrustindex verifies that the original source of the review is Google. Was referred my Korey Bahme and what a great referral.. David and his staff was so professional and truly cares about his clients well being. Would highly recommend. Frank SPosted onTrustindex verifies that the original source of the review is Google. We cannot say enough wonderful things about David and Anne! From start to finish, they guided us through our estate planning with a perfect balance of professionalism and genuine kindness. Their expertise gave us complete confidence, and their patient, thoughtful approach set our minds at ease every step of the way. Estate planning can feel overwhelming, but David and Anne made the process clear, organized, and surprisingly stress-free. They took the time to explain every detail, answer our questions thoroughly, and ensure our wishes were fully understood and documented. We truly appreciate their kindness, integrity, and dedication. We highly recommend them to anyone looking for not just exceptional legal services, but also a team that truly cares.Posted onTrustindex verifies that the original source of the review is Google. Can’t say enough good things about Citadel Law ! David and Ann were able to make me feel comfortable throughout the entire process. I needed David to structure a trust that would protect my disabled Son. David did that and more in a way I knew my Son was protected after my death ! I was impressed when David told me he was going to do everything he knew to protect my Son ! Can’t ask for more than that ! Star rating should go to 10 Stars !! RayPosted onTrustindex verifies that the original source of the review is Google. Korey Bahme was incredibly helpful in advising us on how to set up an LLC for our rental property and providing general guidance and landlord information!Posted onTrustindex verifies that the original source of the review is Google. Citadel Law exceeded our expectations. Anne's attention to customer service was first class. She made us feel very welcome and was very attentive to what our needs were. David took care of us and made sure to find out what our estate needs were. We weren't thoroughly sure what a trust was and what that involved, but he helped us understand, as he has a gift for teaching. He spent alot of time with us making sure we understood everything before making a decision on which direction we wanted to go. The whole experience was excellent. I highly recommend Citadel Law.Posted onTrustindex verifies that the original source of the review is Google. What in the world are we supposed to do? The thought of setting up our estate was something we knew we had to do but was easy to put off until tomorrow. We knew we had to do this out of love for our children and grandchildren. Our search for guidance led us to David and Anne from Citadel. David guided us through the creation of a Trust customized to our needs and desires. Anne was a great compliment to the Citadel team and from the moment we spoke with her we felt much more at ease. David took what is a very complex task and made it simple and understandable. We are so happy we did not put this task off another day. We can now live every day knowing when God calls either or both of us home our children will not be stuck with dealing with the government and will be able to get through the mourning process without the worry of what to do with our estate. That task has been done and thanks to David and Anne the next chapter without Mom or Dad will not be a burden. May God Bless David and Anne's ministry. Yes, ministry for they have blessed us abundantly with their caring service protecting us and our family. Fred & JillPosted onTrustindex verifies that the original source of the review is Google. My two sisters and I hired Citadel Law to complete estate planning for the three of us. While we had fairly simple estates to settle, they treated us as if they were planning for their own families. David and Annie (and Gunner) were wonderful. They made the process easy and a great experience, and didn't try and sell us services we didn't need. Cannot recommend them enough.Posted onTrustindex verifies that the original source of the review is Google. David and his staff were very knowledgeable and professional. I was presented with different options and counseled on which best fit my circumstances. It is my pleasure to recommend them.Posted onTrustindex verifies that the original source of the review is Google. Professional and personal service at the highest level. Highly recommend. Felt respected and listened to.

Local Trust Attorneys Near You – Our Trust Attorneys will help you execute a Trust. Living trust lawyers Chandler will help you with multiple types of Trusts.

Are we the right Trust Attorney in Chandler for you?

Our Trust Attorney in Chandler, Arizona is specialized in Trusts and other Estate Planning strategies. We have a wide range of service areas with a strong background of the best lawyers. Specialized tax lawyers for tax law, Business lawyers for corporate law, etc. We have a good reputation in multiple areas of law.

When a person or a family is looking for an estate planning attorney they usually are trying to protect themselves and their families. They also want to keep the family dynamic healthy and prevent the future generations from fighting each other. Choosing the right person as a beneficiary or executor is crucial to ensure your wishes are fulfilled and your estate is managed as intended. They want to preserve their assets for future generations. Estate planning helps avoid family conflicts by providing clear instructions on asset distribution.

So asset protection should be a key consideration for anyone looking to secure their financial future and protect their hard-earned wealth. Security in financial and estate planning is essential to provide stability and peace of mind for you and your loved ones. Our chandler estate planning services are tailored to the needs of Chandler residents, offering comprehensive solutions including wills, trusts, powers of attorney, and probate avoidance.

Many people mistakenly believe that estate planning is only for the wealthy or elderly, but everyone can benefit from a well-crafted estate plan.

A lot of families or individuals also want to protect their families against situations that can’t be predicted, like car accidents or even divorce. The Trust Attorneys at Citadel Law Firm are here to help you find and execute the best estate planning strategy, a strategy that is unique to your family. And making legal trust documents will require a trusts lawyer to sort everything smoothly.

Naming an executor in your will gives you peace of mind knowing that someone you trust will handle your estate. A will can also be used to name a guardian for any minor children you may have.

Most lawyers bundle trusts with other essential documents like wills and financial powers of attorney. Powers of attorney are important estate planning tools that allow someone you trust to manage your affairs if you become unable to make decisions.

What are the two main reasons to have a Trust?

- Avoid Probate: A trust is a legal arrangement involving the transfer and management of assets by a trustee for designated beneficiaries. Assets can be transferred to another person in two different ways. Assets can either be transferred by a court order, which is usually called the probate process, or by private contract. Probate is a judicial process where the court oversees the distribution of a person’s assets after their death. During probate, the court appoints a personal representative to manage the estate. The personal representative is responsible for notifying creditors, paying any outstanding debts or taxes, and distributing the assets to the rightful heirs or beneficiaries. Properties are transferred based on the decedent’s will, if there is one, or by state law if there is no valid will. The length of the probate process depends on factors like the estate size, the number of beneficiaries, and any disputes concerning the assets. Probate proceedings are public record, which some people may find intrusive. By creating a Trust and properly funding and maintaining that Trust, a private contract is stabilized and probate will most likely be avoided. The living trust always makes less hassle and you do not need to go through the probate process. Unlike a will, which typically undergoes public probate, a trust allows for private and often immediate distribution of assets. Creating a trust can simplify the distribution of assets and ensure that they are passed down to the correct beneficiaries.

Ensure smooth management and distribution of your estate: A trust provides clear instructions for managing and distributing your assets, which helps avoid family disputes and confusion. By establishing a trust, you appoint a trustee to oversee your estate according to your wishes, ensuring your loved ones are cared for and your assets are handled properly. This legal arrangement offers peace of mind and ongoing support for your family’s future.

Which types of Trusts can Citadel Law Firm help you with?

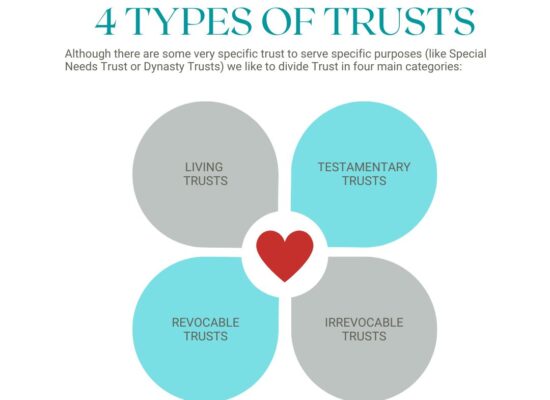

Although there are some very specific trusts to serve specific purposes (like Special Needs Trust, Charitable Remainder Trusts, and Dynasty Trusts ) we like to divide Trust into four main categories:

Living Trusts: a Trust that goes in to effect as soon as it is created, that is why it is called “Living” as the person (or people) creating the Trust is still alive. Our services are included here by the expert trusts lawyers. An Arizona living trust can be a great instrument to keep you out of Probate. Read more about revocable living trusts here.

Testamentary Trusts: a Trust that is created but only goes into effect when the person (or people) named in the Trust passes away. A Testamentary Trust is usually included inside of a Will when a Living Trust can’t be created. It is a less common type of Trust but very effective in protecting assets for the next generations.

Revocable Trusts: it is a Trust that can be changed or revoked. The person/people creating the Trust has the ability to change the terms of the Trust, like the Trustee or the beneficiary, or revoke the Trust completely. A good way to explain also is to say that the Trust “maker” retains the ownership of the Trust. A Revocable Trust is the most common type of Trust that we create, usually also created as a Living Trust.

Irrevocable Trusts: it is a type of Trust that the ownership is giving away and you lose the ability to change or revoke that Trust. Sometimes a revocable trust turns into an irrevocable trust after the passing of the person (or persons) that created the original Trust. In very special circumstances an irrevocable trust can be revoked. Although rare at our law firm we have seen a few cases.

Whether you are a trustee or a beneficiary, a trust administration attorney will provide guidance and assistance to help you understand and fulfill your responsibilities. The expertise of a trust attorney can be invaluable when dealing with complex trust structures, tax considerations, and legal compliance.

Our Trust Attorney Chandler, AZ is here to make sure your family member is well taken care of. We will help you create the right type of Trust for your family. We also help you fund and maintain your Trust across the years. Your successor trustee will have access to a local trust lawyer. Having your estate planning documents in order is important. We can provide you with trust and estate counsel.

By maintaining the Trust properly across years, or even across generations, we will help your family focus in loving each other, not fighting against each other. Our attorneys are some of the best estate planning attorneys in Chandler. They will take into consideration any tax or other issues that arise during your consultation, like long-term care.

If you need any help regarding trust administration or anything else, we are here to provide you free consultation before taking your matters in hand. And our clients are in nearby cities such as Queen Creek, Gilbert, and other cities too. Also, we have covered related practice areas: we can help you with Wills, trusts for Blended Families, as well as with incapacity documents. Our Taxation expertise also helps you understand how your estate planning will affect your federal estate tax and federal estate taxes. Our goal is to reduce estate taxes as part of your estate plan.

Call Citadel Law Firm PLLC today at (480)565-8020 to schedule your free case evaluation with our Trust Attorney in Chandler, AZ. Our top-rated trust super lawyers in Chandler, AZ understand that having the proper trust drafted for your family is essential, When you are facing a family law matter, it’s essential to work with an experienced attorney who understands the nuances of the legal system and can help you achieve a favorable outcome.

Visit our law office during business hours for legal advice. We will do our best to clarify any of your concerns. Even if you want to work with our legal team virtually to establish your trust and other legal papers we will be able to help you.

Contact us today, Our team will be pleased to help you! Trust is what we do, we hope you can trust us with your legal needs. Citadel is a professional, affordable, and fully licensed law firm. Maintaining clear boundaries in the attorney-client relationship is crucial to avoid conflicts of interest and ethical violations

Planning for Long Term Care

When you’re thinking about your future in Chandler, planning for long-term care isn’t just smart—it’s one of the most loving things you can do for your family. I know it’s not easy to think about what might happen down the road, but having a solid plan in place means you’re protecting the people you care about most, no matter what life throws your way. As your estate planning attorney here in Chandler, I’m here to walk you through this process step by step, helping you create strategies that keep your assets safe, ensure you get the care you need, and make the most of any government benefits you might qualify for.

A well-thought-out long-term care plan does much more than just look at what you have today—it looks ahead to what you and your family might need tomorrow. Maybe you’ll face health challenges, need assisted living, or simply want to make sure someone you trust can step in if you can’t make decisions for yourself. That’s where tools like revocable living trusts come in handy. Think of these as special legal containers that hold your assets and come with clear instructions for someone you choose (called a successor trustee) to follow. We also have irrevocable trusts, which are like locked boxes that can provide even stronger protection. These tools don’t just protect your estate—they help your family avoid the headache and expense of probate court and can even reduce the taxes your family might owe later.

If you have young children, a blended family, or a loved one with special needs, we’ll want to get even more specific with your planning. Special needs trusts are particularly important because they’re designed like protective shields—they keep your loved one’s inheritance safe while making sure they don’t lose access to crucial government benefits like Medicaid or disability payments. I’ll sit down with you to understand your family’s unique situation and create a plan that addresses everyone’s specific needs. Every family is different, and your plan should reflect that.

Let’s talk about taxes for a moment—I know, not the most exciting topic, but it’s important. Smart tax planning now can save your family thousands of dollars later. I’ll help you structure things so that your estate faces the smallest possible tax burden, which means more of what you’ve worked for stays with the people you love. When we coordinate your financial planning with how your trusts are managed, we’re essentially building a bridge that carries your legacy safely into the future while providing ongoing support for your family.

Here in Chandler, I believe in being there for you throughout this entire journey, not just when we’re signing papers. From the moment we start drafting your documents to helping manage your trust assets and handling all those administrative details like notifying creditors, I’ll be right there with you. This kind of ongoing partnership gives you something invaluable—real peace of mind. You’ll know that everything is properly arranged and that your loved ones will be taken care of, whatever the future holds.

If you’re ready to take this important step toward securing your family’s future, I’d love to sit down with you for a personal consultation. Together, we’ll create a long-term care plan that protects what matters most to you, provides for your family exactly the way you want, and ensures your wishes are honored for years to come. Let’s start this conversation—your family’s security is too important to leave to chance.

Avoiding the Probate Process

When families come to me worried about protecting their legacy, one of the first things we talk about is avoiding probate—and for good reason. I’ve seen too many families get caught up in Arizona’s probate process, which can stretch on for months, sometimes even years, while your loved ones wait and legal costs pile up. What makes it even harder is that probate is a public process, meaning your family’s private affairs become part of the public record. That’s exactly why I help so many Chandler families explore estate planning strategies that keep things private and make the transition as smooth as possible for those you care about most.

Let me tell you about one of my favorite tools: the revocable living trust. I often describe it to clients as a safe that you control completely while you’re alive, but that automatically opens for your loved ones when you’re gone—no court involvement needed. Here’s how it works: we transfer your assets into the trust, but you stay in complete control as the trustee, meaning you can change anything you want, anytime you want. When the time comes, your handpicked successor trustee simply steps in and distributes everything according to your wishes. No probate court, no public records, no unnecessary delays. Plus, it often helps with tax planning and can provide some protection from creditors—benefits that I find many families didn’t even know were possible.

Now, for some families, we might explore irrevocable trusts, especially when you’re looking for stronger asset protection or have specific tax concerns. I’ll be honest—these require more careful consideration because once you set them up, changes are much more limited. But for the right situation, they can be incredibly powerful. Think of them as moving your assets behind an even stronger protective wall. And if you have a family member with special needs, we can create trusts specifically designed to provide for them without interfering with their government benefits—something I know brings tremendous peace of mind to parents and grandparents.

What I always emphasize to my clients is this: having the right trust documents is only half the battle. I’ve seen too many families think they’re protected, only to discover that their trust was never properly funded or maintained. That’s why I work closely with each family not just to create the right trust for your situation, but to make sure it’s set up correctly and stays current as your life changes. My goal is simple: when the time comes, I want your family to know exactly what to do, with everything in place to honor your wishes without any legal headaches. That’s the kind of peace of mind every family deserves.

Chandler Office Location

If you are looking for a living trust attorneys near me or an irrevocable trust attorney near me in Chandler look no further. We are best living trust attorney near me. We offer free and affordable living trusts reviews as well. Our law Firm offers affordable living trusts, revocable living trust, and estate administration. We also have a background in business law. We are of the best trust law firms in Chandler, AZ. We have attorneys who specialize in trusts. Living trust legal firms can add value to your estate planning, specially if they understand federal estate taxes, tax planning and which trust assets can cause issues. With the right estate planning tool we can protect you and your family the right way. We are also an elder law firm.

Do you want to know how much an estate planning attorney cost? Click here to read our blog article to learn more

Frequently Asked Questions about Trust Attorneys

What is the difference between an estate attorney and a trust attorney?

An estate attorney handles a broad range of legal matters related to estate planning, including wills, probate, and overall asset distribution after death. A trust attorney specializes specifically in creating, managing, and administering trusts, which are legal arrangements that hold and manage assets on behalf of designated beneficiaries. While both work in estate planning, trust attorneys have deeper expertise in trust law and trust administration.

What kind of lawyer do I need to create a trust?

You need a trust attorney or an estate planning lawyer with experience in trust law. These lawyers can help you create the right type of trust tailored to your family’s needs, ensure compliance with Arizona law, and assist with funding and maintaining the trust over time.

When should I hire a trust lawyer?

You should hire a trust lawyer when you want to create a trust to protect your assets, avoid probate, plan for special needs beneficiaries, or manage estate taxes. It is also advisable to consult a trust attorney if you are a trustee needing guidance on trust administration or if you want to update or revoke an existing trust.

What kind of lawyer deals with trust funds?

Trust attorneys or estate planning lawyers handle trust funds. They draft trust documents, guide trustees on their fiduciary duties, assist with trust administration, and help manage the trust assets according to the terms set forth in the trust agreement.

Who is the best person to set up a trust?

The best person to set up a trust is typically an experienced trust attorney who understands your unique family and financial situation, Arizona estate laws, and the types of trusts available. They will help you create a trust that meets your goals, protects your property, and ensures your wishes are carried out.

Can a person do a living trust without a lawyer?

While it is possible to create a living trust without a lawyer using online templates or software, it is not recommended. Trusts can be complex legal arrangements that require careful drafting to ensure they are valid, properly funded, and meet your estate planning goals. Hiring a trust attorney provides ongoing support and helps avoid costly mistakes.

What is the difference between a living trust and an estate trust?

A living trust is created and becomes effective during the grantor’s lifetime, allowing them to manage and control the assets within the trust. It can be revocable or irrevocable. An estate trust, often called a testamentary trust, is created through a will and only takes effect after the grantor’s death. Living trusts help avoid probate and provide privacy, while estate trusts are part of the probate process.