Who gets assets without Will in Arizona?

While this article is meant to explain what happens if you were to die without a will in Arizona, keep in mind that this is not intended as legal advice. If you need legal help please schedule a free consultation.

What happens if I die without a will in the state of Arizona?

The passing of a family member is always a daunting experience. It is important to understand what happens in the absence of a last will and testament or a living trust for an individual's assets to pass on to the decedent's intended beneficiaries.

The absence of a Will will very likely trigger probate. It will most likely be an informal probate or uncontested probate if all the parts are in good terms. The Arizona probate laws are easy to understand and follow. Informal probate will have minimal court supervision. Differently from a formal probate, which is a court supervised probate process with a judge overseeing the probate process.

Any property held in a living trust will likely avoid probate by Arizona rules. However, any property you own in your own name must go through a probate court proceeding for title to pass to your intended beneficiaries if it is above a specific threshold.

Probate is the legal process that determines who will inherit the property and belongings of the deceased. A person appointed as personal representative (also know as executor by some people) will be responsible for the probate process at the probate court. Estate planning attorneys or probate attorneys will be able to help you and guide you through the probate process.

The Arizona probate process follows these procedures:

* Source: Nolo

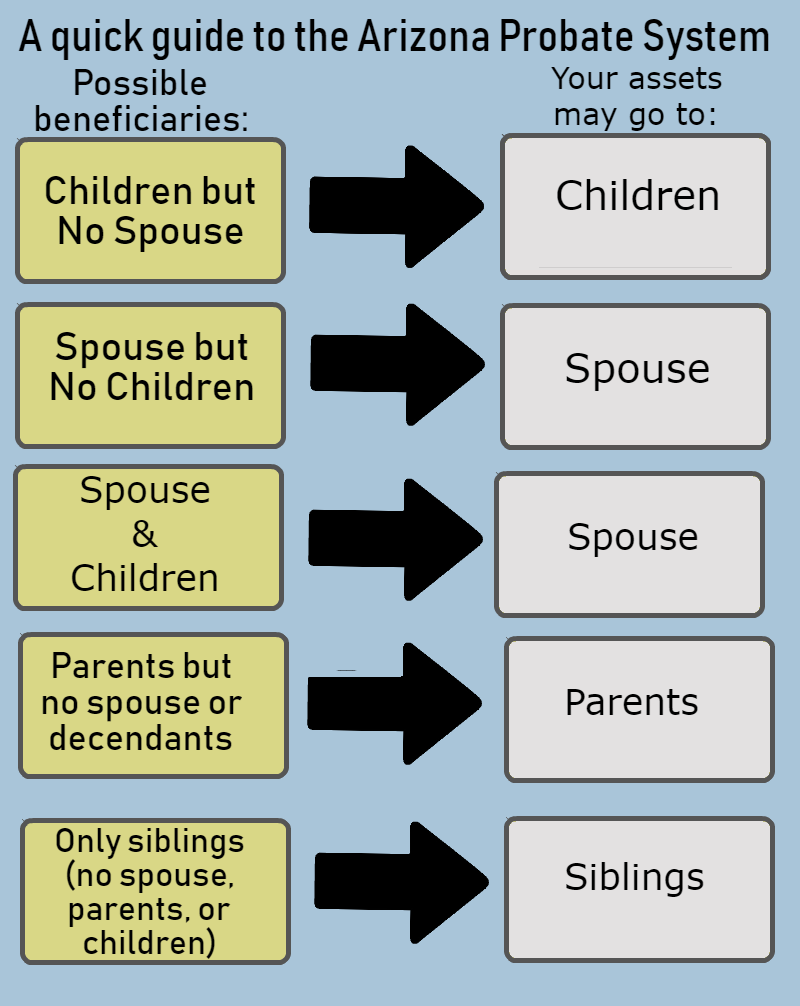

- A person who dies without a valid will is deemed to die "intestate." For such a person, the state's laws of intestate succession will determine who may claim an interest in the decedent's property. Intestate assets will usually pass to a spouse, child, or close relative. Please refer to to the image on the left for a general idea to whom state laws typically assign assets. A decedent's personal safe deposit boxes and bank accounts may be be frozen during this process.

- The administration of the estate includes paying all of the debts that were owed by the deceased. If these debts are equal to or larger than the value of the estate, then nothing will be passed on to a decedent's beneficiaries. Generally speaking, excess debt is not inherited. If debts are higher than all the assets the personal representative files the estate as insolvent. Know creditors of the estate need to be notified by Arizona law during the probate process.

- The amount of time that this process can take varies, but usually it takes from six months up to two years. The whole estate administration and probate process is usually less complicated and it moves faster the less people (usually beneficiaries) that are involved in the process.

Small estates process

A small estate process is also know as small estate affidavit process. If a deceased’s personal property is valued less than $75,000 or their real property is valued less than $100,000, it may be possible to skip the probate process entirely. One must wait at least 30 days after death to start a small estate by affidavit process for personal property and 6 months to start such a process for real property. Additionally, only certain close relatives of the decedent may initiate such a process.

A valid will tends to minimize family discord as it identifies to whom the decedent wished certain property to pass. Additionally, any assets held in a revocable living trust generally skip the probate proceedings entirely. Bank accounts, retirement accounts and other accounts held in trust or with designated beneficiaries as well should also avoid probate. The same is valid for payable of death accounts.

Personal property may or may not be included in probate in Arizona, it will depend how much the personal property valued at. The same is valid for all estate assets although usually the estate's real estate will represent a big part of most people's estate.

Having a Will can alleviate some of the stress of dealing with a legal process during such a turbulent time. Also, it can help to define more complicated asset transfer scenarios, such as when there are multiple beneficiaries or beneficiaries from various unions. In addition, property estate planning with wills and trusts may allow a family to reap potential tax benefits.

Frequently asked questions about probate and Arizona probate laws:

-

When is probate required in Arizona?

Probate in Arizona is required when there are enough assets in the estate to trigger probate. To learn more about it read our blog article about it, click here.

-

Is informal probate much easier than formal probate?

The short answer is depends. A formal probate where all parts are in agreement may be easy as well. Sometimes the judge just want to ask some clarification during formal probate proceedings.

A formal probate where all the parts are not in agreement will be much more complex though. It will be much more expensive and time consuming. The personal representative will have to be more careful and diligent in this case.

-

How much does it cost to file probate?

The cost to file for probate depend of the court that your probate is subject to. Court costs vary from county to county. Working with an experienced estate planning attorney can save the personal representative and the family a lot of headache, as well as time.

To understand all the costs involved please read our blog about how much probate cost on Arizona, click here.

-

How is community property treated during informal probate proceedings?

Arizona probate laws are clear in relation to community property. Usually the surviving spouse gets all assets if the deceased person had no children from a previous marriage and there are no beneficiaries in any of the accounts, as well as no joint tenancy or any other specifications in any real property deeds. We do recommend talking to an attorney to review all estate assets to avoid any issues.

Probate in Arizona will still be necessary and the spouse of the deceased person has priority as personal representative.

-

Are life insurance policies subject to probate?

Life insurance policies may or may not be subject to probate. It will depend if beneficiaries are assign to it or not. Check with the insurance company first and talk to a probate lawyer in Chandler, AZ if you need help. Is most cases a surviving spouse is named as beneficiary in an insurance policy. Make sure to check if any estate taxes are applicable to it. An final Income statement will have to be submitted to the IRS for the estate of the deceased person.

-

Should I hire legal counsel if I am a beneficiary if an informal probate process?

The process at an Arizona probate court is strongly supervised even if court appearance is not necessary by the personal representative. The personal representative's actions are also liable and responsible for all the estate's personal property and all property. If you don't trust them you can either hire an independent probate attorney to review any documents that you have to sign. During the probate procedure you will be asked to waive bond and also waive inventory and account, you can always decide to not waive any of that as a safety measure. An informal probate can also be turned into a formal probate (supervised probate) if you believe that the personal representative is not performing their duties.

To learn more about Arizona's intestate succession laws please go to Arizona Revised Statutes § § 14-2101 to 14-2114. You can also check our article "What is the difference between a will and a trust?" to learn more about Wills.

If you need legal assistance, please schedule a free consultation today. Our attorneys practice Estate Planning law and look forward to working with you.